GAAP sets standards for a wide array of topics, from assets and liabilities to foreign currency and financial statement presentation. LIFO (Last In First Out) is a widely used inventory valuation method that finds application in various industries. Although using the LIFO method will cut into his profit, it also means that Lee will get a tax break.

- As a result, LIFO doesn’t provide an accurate or up-to-date value of inventory because the valuation is much lower than inventory items at today’s prices.

- It’s good as it results in a lower recorded taxable income, giving businesses a lower tax bill.

- In addition, there is the risk that the earnings of a company that is being liquidated can be artificially inflated by the use of LIFO accounting in previous years.

- Cost of goods sold is an expense for a business, meaning it will also have tax implications.

- He or she will be able to help you make the best inventory valuation method decision for your business based on your tax situation, inventory flow and recordkeeping requirements.

- For the 200 loaves sold on Wednesday, the same bakery would assign $1.25 per loaf to COGS, while the remaining $1 loaves would be used to calculate the value of inventory at the end of the period.

Average Cost

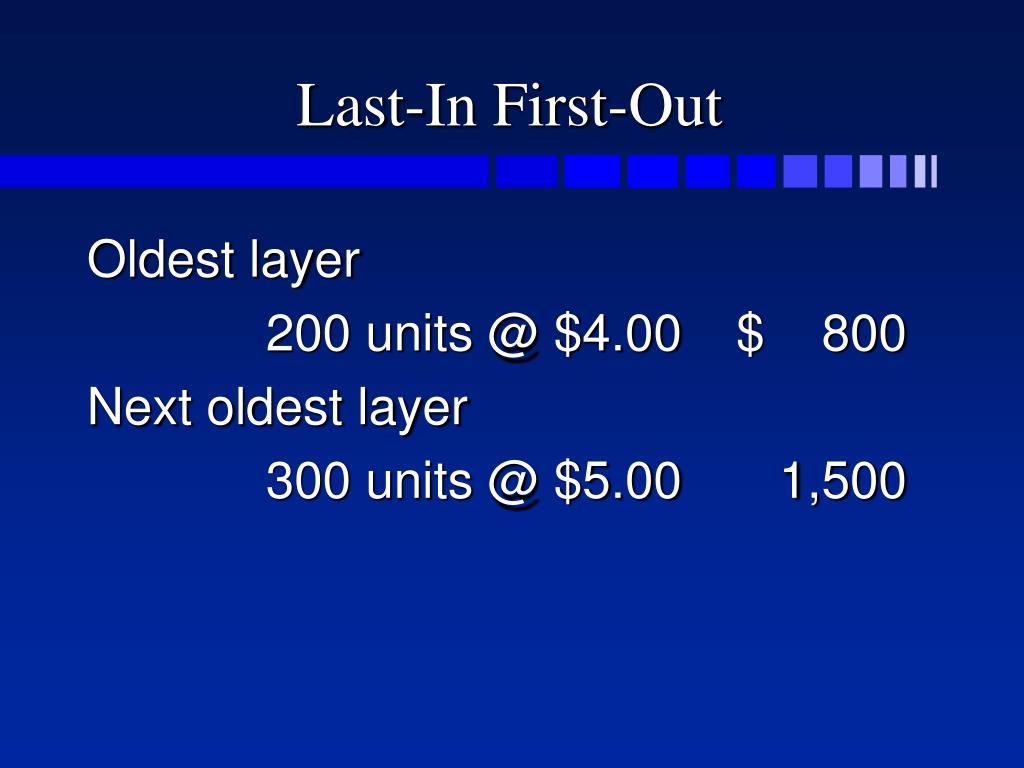

The cost of the remaining 1200 units from the first batch is $4 each for a total of $4,800. Some companies believe repealing LIFO would result in a tax increase for both large and small businesses, though many other companies use FIFO with few financial repercussions. If prices are falling, earlier purchases would have cost higher which is the basis of ending inventory value under LIFO. In a period of falling prices, the value of ending inventory under LIFO method will be lower than the current prices. The reason for the difference is that the periodic method does not take into account the precise timing of inventory movement which is accounted for in the perpetual calculation.

FIFO vs. LIFO: How to Pick an Inventory Valuation Method

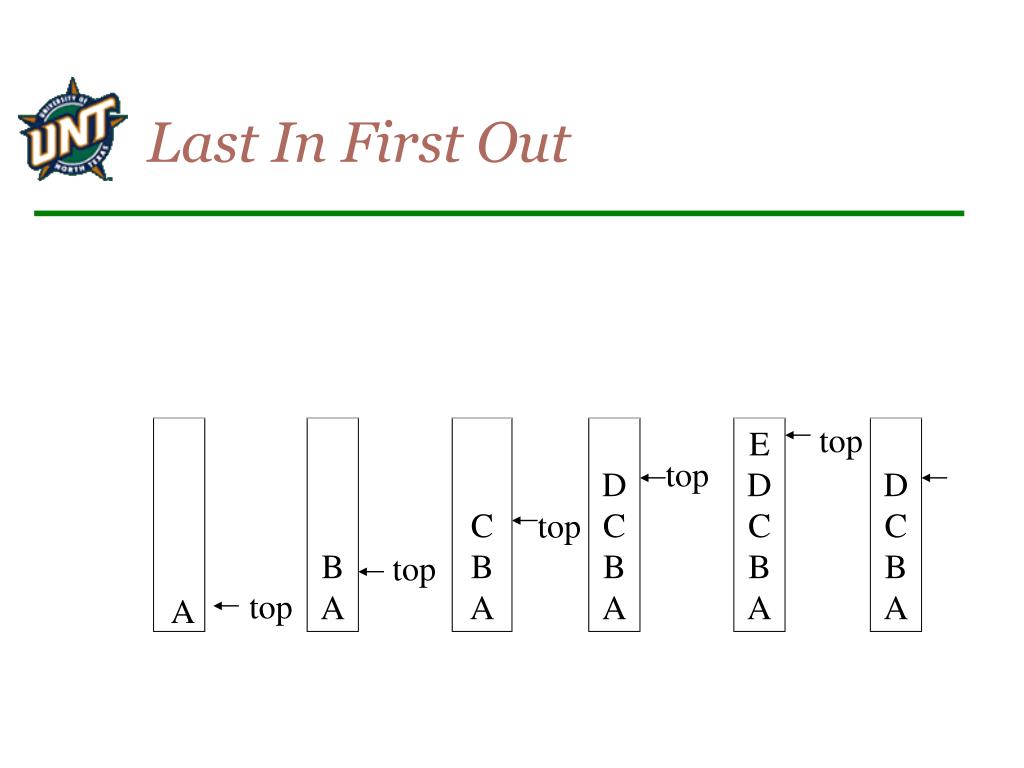

The later costs recorded on the materials ledger cards are used for costing materials requisitions, and the balance consists of units received earlier. When prices are rising, it can be advantageous for companies to use LIFO because they can take advantage of lower taxes. Many companies that have large inventories use LIFO, such as retailers or automobile dealerships. Last in, first out (LIFO) is a method used to account for how inventory has been sold that records the most recently produced items as sold first.

FIFO vs LIFO: Comparing Inventory Valuation Methods

Under inflationary economics, this translates to LIFO using more expensive goods first and FIFO using the least expensive goods first. In many cases, customers prefer to have newer goods rather than older products. Particularly if you work in an industry where goods decay over time, using LIFO can ensure that customers receive fresh goods.

Calculate the value of ending inventory, cost of sales, and gross profit for Lynda’s first six days of business based on the LIFO Method. Although the ABC Company example above is fairly straightforward, the subject of inventory and whether to use LIFO, FIFO, or average cost can be complex. Knowing how to manage inventory is a critical tool for companies, small or large; as well as a major success factor for any business that holds inventory. Conversely, not knowing how to use inventory to its advantage, can prevent a company from operating efficiently. For investors, inventory can be one of the most important items to analyze because it can provide insight into what’s happening with a company’s core business.

LIFO is often used by gas and oil companies, retailers and car dealerships. Auto dealerships deal with inventory that encompasses vehicles, spare parts, and accessories, all subject to price fluctuations in the automotive market. Let’s take the example of a car dealership that regularly acquires new vehicle models from manufacturers. With each new shipment, the dealership faces varying product quality in operations and supply chains costs due to changes in production, transportation, and market demand. By assuming that the most recently added vehicles are the first ones sold, the dealership can accurately reflect the current market values and ensure profitability. Additionally, LIFO allows auto dealerships to minimize tax liabilities by adjusting the cost of goods sold based on the latest inventory acquisitions.

Under LIFO, September products are sold first even if July products are left over, leaving the remaining at a low value. When a company selects its inventory method, there are downstream repercussions that impact its net income, balance sheet, and ways it needs to track inventory. Here is a high-level summary of the pros and cons of each inventory method. All pros and cons listed below assume the company is operating in an inflationary period of rising prices. Since LIFO uses the most recent, and therefore usually the more costly goods, this results in a greater expense recorded on a company’s balance sheet.

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

For goods that decay over time, like perishable items or trend-based goods, this can mean that the remaining inventory loses value. The LIFO reserve is the amount by which a company’s taxable income has been deferred, as compared to the FIFO method. This is because when using the LIFO method, a business realizes smaller profits and pays less taxes. The LIFO method assumes that Brad is selling off his most recent inventory first. Since customers expect new novels to be circulated onto Brad’s store shelves regularly, then it is likely that Brad has been doing exactly that. In fact, the very oldest inventory of books may stay in inventory forever and never be circulated.